Is the Dollar Still King? Shocking Shifts in the Currency War

For much of the last century, the US Dollar has maintained its dominance as the Global Reserve Currency, powering international trade, investment, and the broader global currency markets. But in 2025, shifting economic powers, digital innovation, and strategic realignments have raised a critical question: is the dollar’s supremacy under threat?

The Dollar Rate Today: A Telling Trend

As of June 2025, the US Dollar Index (DXY) is hovering around 98.60, showing a decline of over 2% from its May levels. The greenback has lost ground to top global currencies, such as the euro, Swiss franc, and Japanese yen, driven by a combination of U.S. rate cut expectations and increasing geopolitical tensions.

The current trend highlights increasing currency value fluctuations, presenting both risks and opportunities in global currency trading.

Currency War in Motion

A silent currency war is underway, one that is less about confrontation and more about strategic disengagement. Many nations are gradually diversifying away from the dollar, driven by concerns over political risk, excessive reliance on U.S. monetary policy, and shifting trade alliances.

Recent currency war news includes:

-

BRICS+ discussions on creating alternative payment mechanisms.

-

Increased bilateral trade settlements in yuan, euro, and dirham.

-

Central banks are raising gold reserves while reducing dollar exposure.

This represents a cautious, but coordinated, shift away from dollar dependency in the global foreign exchange markets.

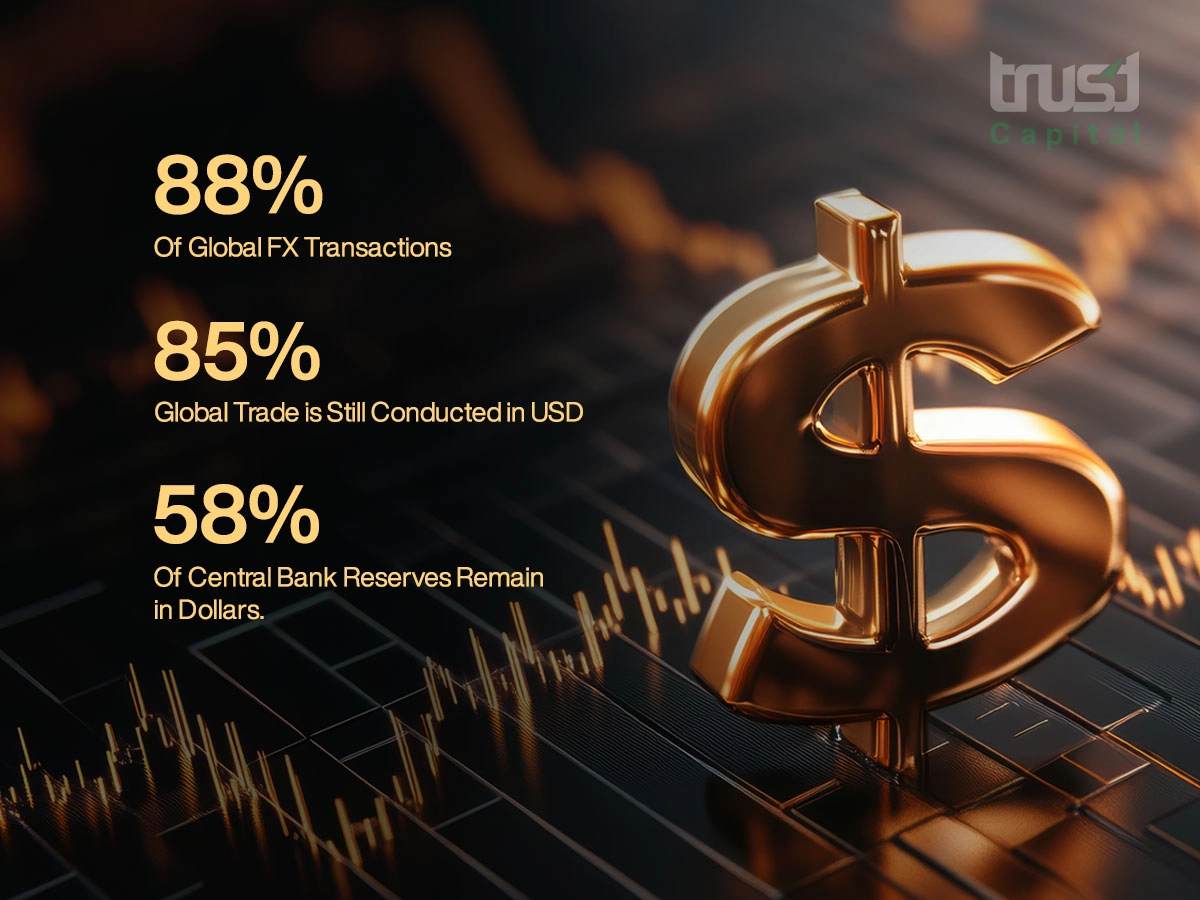

The Dollar’s Grip on Global Trade

Despite emerging alternatives, the role of the US Dollar in international trade remains substantial:

-

It’s involved in nearly 88% of global FX transactions.

-

Over 85% of global trade is still conducted in USD.

-

The IMF reports that 58% of central bank reserves remain in dollars.

This dominance is supported by deep liquidity, the strength of U.S. financial institutions, and long-standing trust in the dollar system.

However, the structure is evolving, not collapsing. A slow but noticeable shift in global currency trends is taking place.

Global Currency Market Today: Multipolar Movements

In today’s interconnected economy, no single currency seems capable of replacing the dollar outright. But combined, top global currencies like the euro, yen, and yuan are gaining ground in trade, reserves, and investment flows.

Meanwhile, emerging market currencies are becoming more resilient, supported by better monetary frameworks, stronger reserves, and digital currency adoption. The result? A more multipolar global currency market, one where power is shared rather than centralised.

Implications for Traders and Investors

For those navigating the global currency markets, including users on platforms like Trust Capital, this shift comes with key takeaways:

-

Volatility is opportunity: The dollar’s instability creates trading potential across major pairs.

-

Diversification matters: Exposure to non-USD currencies like EUR, JPY, and CHF helps hedge against value swings.

-

News drives moves: Monitoring currency war implications is essential to staying ahead of market changes.

Staying alert to trends like the US Dollar vs Emerging Market Currencies, central bank policies, and digital finance is more crucial than ever.

The Verdict: Still King, But Watch the Throne

Its infrastructure, legal backing, and liquidity remain unmatched. However, as more nations explore alternatives, the dollar’s dominance could gradually erode—not through collapse, but through calculated diversification.

Traders, investors, and policymakers should view this moment not with fear, but with awareness. The currency war is real, but the battlefield is global and evolving daily.

In a rapidly changing world, staying informed is your best strategy. Keep a close eye on the dollar rate today, track global currency trends, and position yourself wisely in the face of an uncertain but opportunity-filled future.